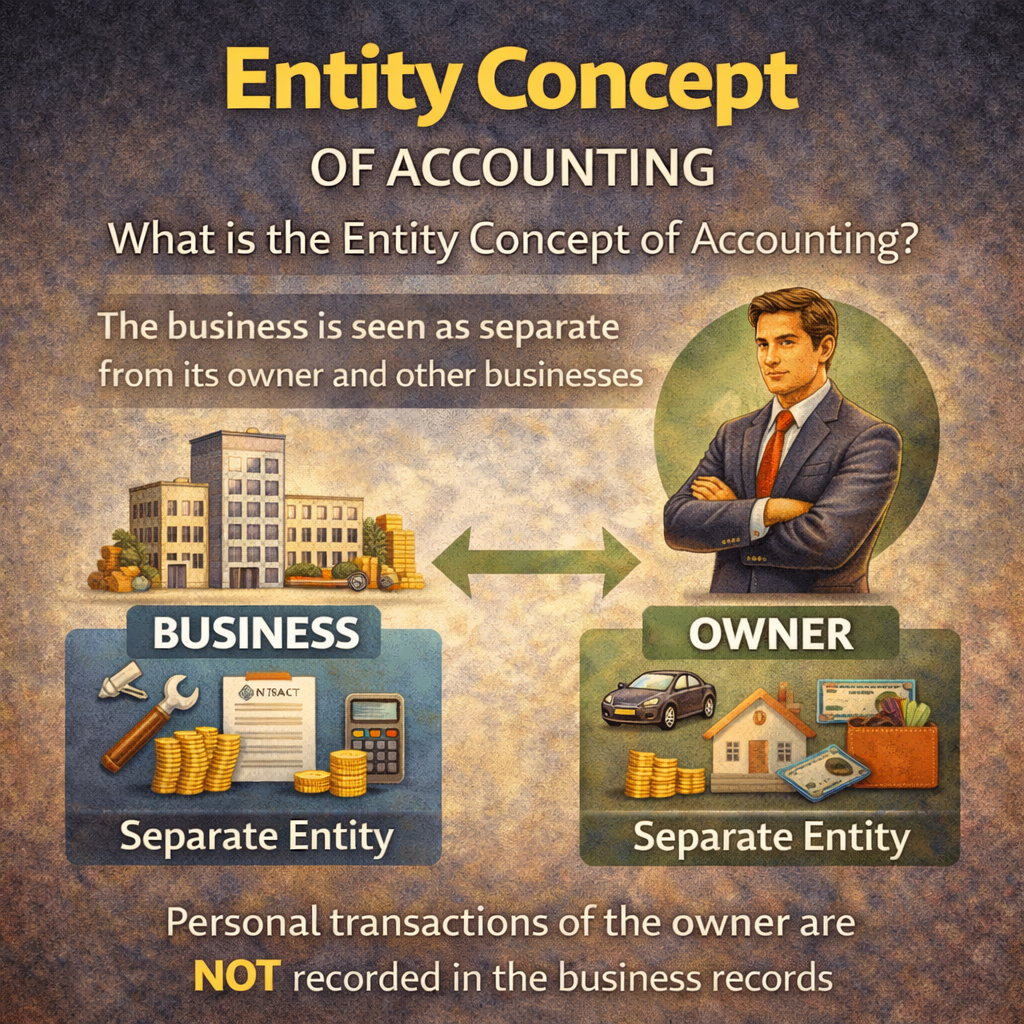

Introduction: The Wall Between Your Wallet and Your Business

If you're a business owner, especially a sole proprietor, you might find it strange when your accountant insists on a strict separation between your personal and business finances. After all, it's your money, right? But in the world of accounting, your business is treated as a completely separate person from you, the owner. This fundamental rule, known as the "Entity Concept," is one of the most important principles for understanding your business's true financial health. This article will break down this concept and explain why it's so crucial for accurate bookkeeping.

Takeaway 1: Your Business Owes You Money

One of the first surprising implications of the entity concept is how it views your initial investment. When you put your own money into your business, it's not a loan in the traditional sense, but an investment of what accountants call "risk capital." From that moment on, the business is considered a separate entity that is liable to you for the capital you invested.

According to this principle, the "Entity concept means that the enterprise is liable to the owner for capital investment made by the owner." This liability to you, the owner, is what forms the "Owner's Equity" or "Capital" account on the balance sheet, which is the primary measure of your financial stake in the business.

Takeaway 2: Paying Your Personal Bills Isn't a Business "Expense"

This is where the entity concept has its most practical, day-to-day impact. If you use business funds to pay for a personal expense, like your child's school fees or family groceries, that transaction is not a business "expense." Instead, accountants record this as a "drawing."

A drawing is a withdrawal of funds by the owner that reduces their capital investment in the business. It’s treated as you taking back a portion of the money the business owes you, not as an operational cost of the business itself.

Example Illustration: Mr. X's Business

Let’s look at a clear example to see how this works and why it’s so important for keeping the books balanced.

Initial Investment: Mr. X starts a business by investing ₹7,00,000. He uses this money to purchase machinery for ₹5,00,000 and keeps the remaining ₹2,00,000 as cash in the business. From an accounting standpoint, the business now has ₹7,00,000 in assets, which are balanced by the ₹7,00,000 it owes back to Mr. X (his capital).

Initial Financial Position | Assets | Liabilities & Equity | | :--- | :--- | | Machinery: ₹5,00,000 | Capital: ₹7,00,000 | | Cash: ₹2,00,000 | | | Total Assets: ₹7,00,000 | Total Liabilities & Equity: ₹7,00,000 |

Personal Expense: Mr. X then uses ₹5,000 from the business's cash to pay for his "family expenses."

The Accounting Treatment: This ₹5,000 is not recorded as a business expense. Instead, it is treated as a drawing. This transaction has a dual effect: it reduces the business's Cash (an asset) by ₹5,000 and it reduces Mr. X's Capital (his equity) by the same amount.

The Result: Notice how the accounting equation (Assets = Liabilities + Equity) remains perfectly in balance. The business now has fewer assets, but it also owes less to its owner.

Revised Financial Position | Assets | Liabilities & Equity | | :--- | :--- | | Machinery: ₹5,00,000 | Capital: ₹6,95,000 | | Cash: ₹1,95,000 | (₹7,00,000 - ₹5,000 Drawing) | | Total Assets: ₹6,95,000 | Total Liabilities & Equity: ₹6,95,000 |

This ensures the business's performance isn't distorted by the owner's personal financial activities.

Takeaway 3: This "Separation" is the Secret to Accurate Financial Reporting

The entity concept isn't just an arbitrary rule; it is the foundation for accurate financial reporting. This principle originated in the "early days of the double-entry book-keeping" and remains critical for several key reasons:

Clarity: It helps in "keeping business affairs free from the influence of the personal affairs of the owner." Without this separation, it would be impossible to know if the business itself is actually profitable.

Accurate Measurement: By treating the business as a distinct entity, you can accurately measure its true performance and financial position.

Universal Application: This concept is applied to all forms of business organizations, from the smallest sole proprietorship to a partnership or a large corporation.

Conclusion: A New Perspective on Your Business

The entity concept creates a necessary financial boundary that allows you, your accountant, and other stakeholders to see your business's performance clearly and objectively. By treating the business as its own "person," you can make better decisions based on its actual financial health, not a mix of personal and business transactions.

Now that you see your business as its own distinct financial entity, how might that change the way you track its success and plan for its future?

![Manusmriti [English / Hindi]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1581014/ChatGPT-Image-Jan-11-2026-052933-PM.png)

![Ramayana [Multi Languages]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1580625/ChatGPT-Image-Jan-11-2026-030025-PM.png)

![Chanakya Neeti Darpan [चाणक्य नीति दर्पण]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1580618/ChatGPT-Image-Jan-11-2026-025628-PM.png)

![Hastrekha Vigyan and Panchanguli Sadhana [हस्तरेखा विज्ञान और पंचांगुली साधना]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1580432/ChatGPT-Image-Jan-11-2026-114757-AM.png)

![Ayurveda [Hindi]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1580425/ChatGPT-Image-Jan-11-2026-113658-AM.png)

![Ayurveda [English]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1580420/ChatGPT-Image-Jan-11-2026-113658-AM.png)

![Geeta [All Languages and Versions]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1580166/ChatGPT-Image-Jan-11-2026-100503-AM.png)

![Aatmbodh [आत्मबोध]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1580164/ChatGPT-Image-Jan-11-2026-095746-AM.png)

![Bhagwat Geeta Explanation in Hindi [Audio Only]](https://sk0.blr1.cdn.digitaloceanspaces.com/sites/66972/posts/1523215/ChatGPT-Image-Dec-24-2025-075732-PM.png)

Write a comment ...